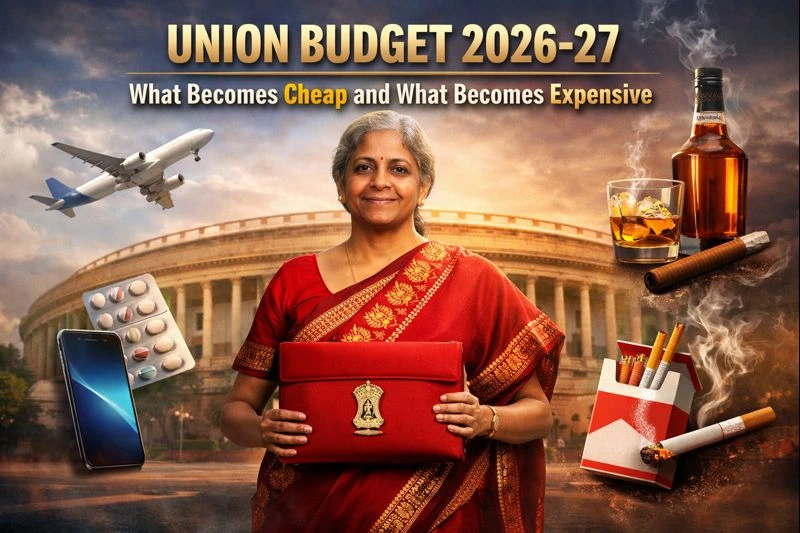

On February 1, 2026, Finance Minister Nirmala Sitharaman presented the Union Budget 2026-27 in Parliament. This annual budget outlines how the government plans to spend money, collect taxes and regulate duties — and most importantly for common people, how it affects everyday prices.

This year’s budget focuses on boosting economic growth, supporting manufacturing, making healthcare and travel less expensive and tightening tax compliance. Let’s break it down in a way that’s easy to understand and useful for your daily life.

What Becomes Cheaper for Common People?

a. Everyday Goods and Electronics

- Smartphones and tablets made in India may see a price drop because import duties and taxes on key components are reduced.

- Microwave ovens and sports equipment will also become more affordable as basic customs duty exemptions help reduce manufacturing costs.

b. Health and Medicines

- 17 life-saving drugs, especially for cancer and diabetes, are now exempt from basic customs duty. This should help make these medicines cheaper for patients.

c. Travel and Education Abroad

- Taxes applied when you pay for foreign tours, education fees abroad or medical treatment overseas are reduced. For example, the Tax Collected at Source (TCS) on overseas tourism packages is now 2% down from much higher rates.

d. Fishing & Export-Linked Goods

- Fish caught by Indian fishermen in Indian waters and the high seas will be duty-free, potentially lowering seafood prices and supporting fishing communities.

- Inputs for marine products, leather exports and textiles will see duty reductions, which can reduce processing costs and make end products cheaper.

e. Cheaper Personal Imports

- If you import goods for personal use (like gadgets or accessories), the import duty on those goods has been cut from 20% to 10%, which should lower the cost for individual buyers.

What Becomes Costlier After This Budget?

While many items get cheaper, there are also areas where costs will rise:

a. Alcohol and “Sin Goods”

- Tax rates on alcoholic drinks and some undesirable products like tobacco items will be higher. This increases the retail price of these goods.

b. Trading & Financial Transactions

- Some financial transactions — like certain stock trading actions — will attract higher charges, including a higher Securities Transaction Tax (STT). This impacts investors and traders.

c. Select Imported Items

- While many duties are cut, some items such as potassium hydroxide, umbrellas and similar imports are now subject to higher duties to protect local manufacturing.

How Your Daily Costs Are Impacted

Let’s break it down in simple real-world examples:

✔ Cheaper

- Your next smartphone made in India could cost less.

- Medicines you or elders depend on may see price relief.

- Overseas holiday packages might become noticeably cheaper, especially for frequent travelers.

- Sports gear for kids may cost less, helping families save.

✘ Costlier

- Alcohol bought at stores could cost you more due to higher taxes.

- If you trade stocks regularly, brokerage and taxes may pinch your pocket.

- Some imported lifestyle goods might get pricier depending on new duties.

Big Picture: What the Budget Aims For

Beyond just cheaper and costlier price tags, the budget also aims to:

- Strengthen domestic manufacturing (like semiconductors, EV batteries, solar equipment).

- Boost infrastructure projects like high-speed rail and waterways.

- Support farmers and high-value agriculture (like coconut, cashew, cocoa).

This means more jobs, more growth and eventually a stronger economy — which matters to every Indian household.

Personal View and Conclusion

The Union Budget 2026-27 is clearly a rebalance budget. Instead of only cutting taxes, it rewards sectors that help long-term growth like healthcare, green energy and domestic manufacturing. At the same time, it increases costs on non-essential or harmful goods.

For ordinary families, this means some immediate benefits like cheaper medicines, devices and foreign travel costs. But you may spend more on alcohol, luxury imports, and certain financial activities.

Overall, the budget tries to chart a middle path — supporting growth while attempting to ease everyday costs where it matters most.

Frequently Asked Questions (FAQ)

Q1. Will smartphones become significantly cheaper after Budget 2026?

A1. Yes. With lower import duties and tax breaks on key components, domestically made phones should see price reductions.

Q2. How does the reduction in TCS benefit foreign travel?

A2. The Tax Collected at Source on overseas tour packages is now set at 2%, down from up to 20%, making international holidays more affordable.

Q3. Are all medicines getting cheaper?

A3. Not all, but 17 key drugs including cancer and diabetes medicines have been exempted from import duty, which should lower costs for those medicines.

Q4. Why do some financial transactions become costlier?

A4. The government increased taxes like Securities Transaction Tax to regulate markets and reduce tax avoidance.

Q5. What does duty exemption mean for products like EV batteries and solar panels?

A5. Exemptions on duty for components help lower production costs and can lead to cheaper final products.

Q6. Will everyday grocery items become cheaper?

A6. This budget did not directly cut taxes on groceries, but food produced domestically might benefit indirectly from agricultural support measures.

To get the Latest Trending News, Please follow Popnewsblend.com

Hi, I’m Prashant Jain — a curious soul, storyteller, and content creator at heart.I’ve always been drawn to the world of entertainment, travel, sports, health & lifestyle — not just as a writer, but as someone who genuinely lives these experiences. Whether I’m binge-watching the latest OTT series, exploring offbeat spiritual destinations in India, or diving deep into wellness routines and cricket match insights, I love sharing what I discover with like-minded readers.

PopNewsBlend is my way of blending personal journeys with meaningful stories — ones that inform, inspire, and keep you ahead of the curve. Everything I write comes from real observations, hands-on experiences, and a deep passion for understanding the world around us.

Discover more from Popnewsblend

Subscribe to get the latest posts sent to your email.